Roblox - an in-depth analysis

Roblox has gone public at almost $40bn. Here's my take on the company and a detailed breakdown of key parts from the prospectus.

Overview

Roblox is an online platform where users play, explore, and socialise in virtual 3D experiences created mainly by other users. You sign up and create an account, are greeted with a landing page full of icons that represent experiences, and jump into any of them. Alongside this, you choose and customise an avatar and have a friends list. The platform Roblox has created boasts one of the biggest UGC (‘User Generated Content’) driven platforms in a 3D virtual space setting, with over 18 million available experiences accessed by 32.6m Daily Active Users (‘DAU’) generating $1.9bn bookings in 2020

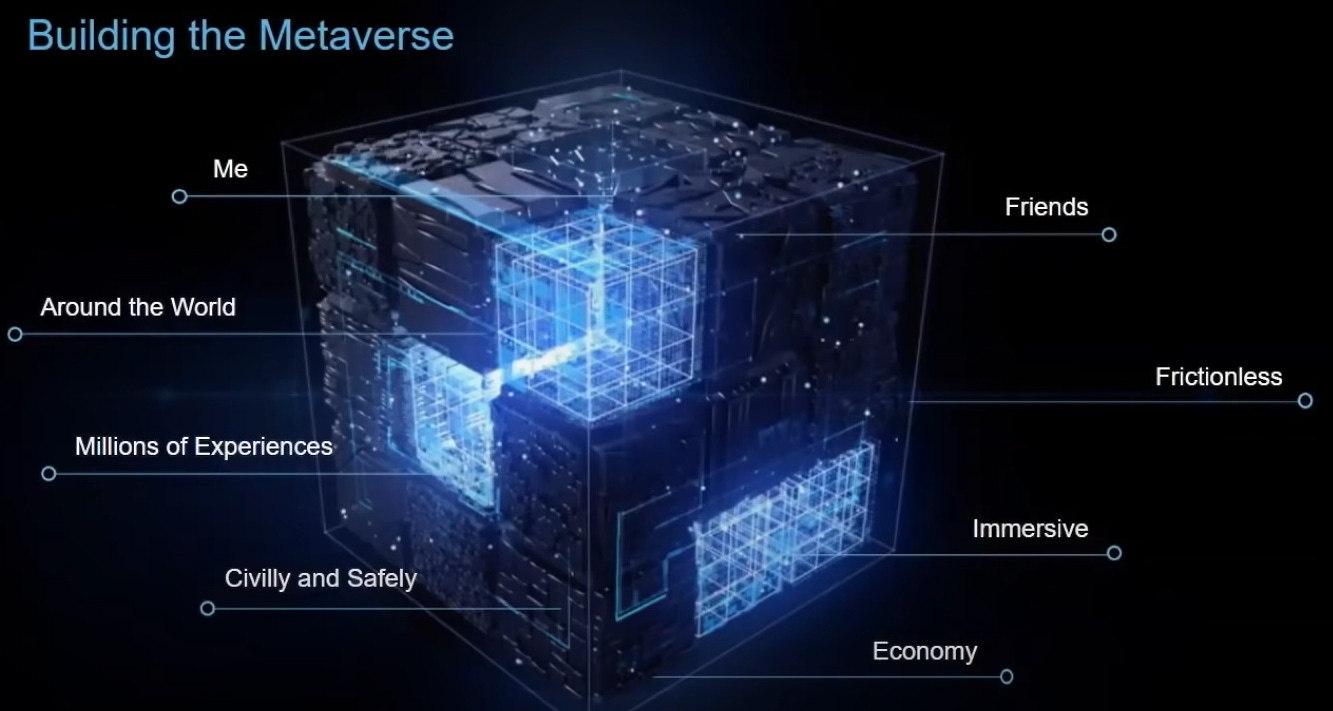

Currently, the company describes Roblox as a place for people to “play, learn, communicate, explore, and expand their friendships, all in 3D digital worlds that are entirely user-generated” and dub this category as the “human co-experience”. The company’s ultimate vision can be distilled into the biggest buzzword of the past year in gaming: the metaverse. This term has been increasingly spoken about a lot over the prior year, most notably by Tim Sweeney, Founder and CEO of Epic Games. The word is getting far too overused, but in this case, it is appropriate. The term has been mentioned 15 times defined as a persistent, shared, 3D virtual space in a virtual universe. It’s a good definition, but I’d like to add Tim’s description, which includes: “...where people can create and engage in shared experiences, as equal participants in an economy, with societal impact.” This drives home what Roblox is trying to build, which isn’t just another virtual world but somewhere where players share meaningful social experiences and can fairly compete and participate in the value created from the platform.

This is where Robux comes in, the virtual currency of the Roblox world and the medium in which Developers and Creators that create experiences can monetise and make money from doing so. In the last 12 months, over 7 million individual developers were populating Roblox, and they range from tinkerers to real businesses. 1.2m of these made money, 305 made over $100k, and 36 made over $1m.

The Roblox Platform can be broken down into three key parts:

Roblox Client: the front end that users log in to explore, play and participate in virtual worlds

Roblox Studio: the tool used by developers to create these experiences

Roblox Cloud: the backend services and infrastructure that powers the platform

Describing what the company does is in some ways straight forward, providing a platform to create and engage in 3D shared virtual experiences. The company makes money through players buying Robux, which is spent on experiences and avatars. The company aims to build the next-generation entertainment and virtual platform, delivering immersive and enjoyable experiences, built social-first with a deeply engaged community. Understanding how they do it, why players have come to Roblox in huge numbers and loyalty, the product and strategic choices made to facilitate this is much more difficult. I will explore these topics with commentary on data released in the filing, including breakdowns of the business model, the platform, growth strategy, developers, users, KPIs and financials.

Thesis summary

Investment thesis

Roblox has successfully grown a platform that delivers on digital experiences through UGC (user generated content) and social gaming, creating a two-sided network effect - more users create more content, more content generates more value for users.

The platform offers a continually changing selection of game experiences built around social features, which is difficult to replicate, and there are no competitors on any significant scale.

Their focus on enabling developers to create compelling content with the Roblox Studio, developer program and network, the marketplace and compensation through Robux incentivises continuous and improving content overtime. The developer base is 7m with the top 1,000 earning over $10k annually.

Roblox has a large, engaged user base of 32M Daily Active Users in 2020. Roblox is still relatively underpenetrated in geographies outside of the US and Western Europe, presenting growth from purely new audiences and is building its capabilities to localise its experiences. The most significant mid/long-term opportunity here is China, where they recently obtained approval for a joint venture with Tencent, which could easily double their player base.

Roblox will increase engagement and spend per user by continuous platform improvements, including more sophisticated experiences, higher age-rated games and better avatar technology. The introduction of Premium membership will also provide more stable revenue.

Almost all of Roblox’s growth is organic and spends very little on marketing (3% of 2020 bookings), resulting in value accreting revenue growth.

As the set of potential experiences grows on Roblox through collaborations with music artists, TV/film IP, and consumer brands, Roblox will open up new business models which are currently being validated through a variety of partnerships.

Today’s youth are entirely comfortable, and sometimes prefer, socialising and spending time in virtual environments. As more real-world activities converge with digital equivalents, Roblox is well-positioned to capture this shift and create the next generation entertainment company

Bear thesis

Roblox is still heavily weighted towards a young demographic group (54% under 13s), and although Roblox is growing a slightly older demographic, they may not be able to build an older audience. Gamers are increasingly present across older demographics which have more spending power.

Having such a young userbase means Roblox needs to be laser-focused on making sure their content is safe - both from suitable content, as well as from bad agents and scambots. Roblox has outlined that safety is their top priority. Still, if mistakes are made there could be significant backlash from not only parents but potentially from governments that place restrictions on access or content.

The increasing reliance on bookings through Apple and Google will not only increase costs significantly but will mean that Roblox is beholden to the terms from these app stores. If Apple decides they can’t allow Roblox to allow users to buy Robux outside their app or do not approve platform updates beneficial to Roblox, this could limit their growth.

Near term, growth will come from Roblox expanding into different geographies where gaming preferences and compliance from the government will differ. There is no guarantee that users in new countries will enjoy Roblox in the same way users from the US and Western Europe do.

The growth experienced in 2020 is exceptional due to COVID, with spend and engagement likely returning to pre-2020 levels. Bookings growth in 2019 was ‘only’ 39% compared to 171% in 2020.

Roblox is reliant on the quality of content from developers. If their platform stagnates as it cannot provide compelling features so developers can create the experiences they want, they may leave for other competing platforms that offer better economics and/or prospects. There could also be IP violation issues as Roblox grows and popular games do not have specific rights. Their ability to curate and keep quality developers as well as moderate content may be difficult to maintain.

The metaverse concept, as well as brand and media collaborations, may serve as an effective marketing tool for one-off events but is too speculative to bet that it will convert into real revenue for Roblox. Many online platforms in the past two decades have attempted to capture online education and work but have failed to realise this vision in any significant size.

Market and Metaverse

The gaming market has grown considerably and consistently hitting $175bn this year, up c. 20% from 2019 driven by lockdown measures (source: Newzoo, disclosure: I work there) and is forecast to hit $218bn by 2023. But for a leading company like Roblox, it’s better to contextualise their near-term opportunity with the 2.7bn gamer audience. Over half of that audience is in Asia, with 210m in the US and 386m in Europe. Over the last decade, the boom in gaming has been primarily driven by mobile becoming more affordable, releasing higher specs and better internet speeds, enabling better experiences. Over that time, free-to-play mobile games evolved significantly, innovating game design, monetisation techniques, and technology advancements.

These are all relevant to macro-level drivers for Roblox, as the game itself started on PC but now has a significant mobile presence. The definition of what a gamer is has significantly expanded and is not limited to people who like to build their own gaming rigs. It’s now completely normal to go online, spend time with friends gaming, create and share gaming memes and have your favourite celebrities be Twitch streamers or YouTube gamers. This is the world that the youth are now growing up in, and engaging with a game comes in many forms.

When you put these trends in context with gaming making the overwhelmingly large majority of total consumer spend in mobile overall (Q3 2020 80% for App Store, 65% for Google Play), it’s clear that Roblox has an established large market in its current form.

The real long-term prize is with the creation of the metaverse, in which they will “support a broader range of educational and social experiences”. Their vision is to build in-depth virtual worlds where they ‘expect people to engage in a vast range of activities, such as visiting ancient Rome, going to an awesome concert, or dissecting a simulated frog with others in an online classroom’. Roblox, alongside Epic Games’ Fortnite, is one of the best current contenders to create an early version of a metaverse. Roblox has already hosted weddings, birthday parties, concerts and special events with DC IP Wonder Woman. If Roblox does truly begin to execute on providing high fidelity, more sophisticated experiences that span outside of games, then the opportunity here is potentially huge.

Matthew Ball, an investor and thought leader in media/gaming has an optimistic take:

Even if the Metaverse falls short of the fantastical visions captured by science fiction authors, it is likely to produce trillions in value as a new computing platform or content medium. But in its full vision, the Metaverse becomes the gateway to most digital experiences, a key component of all physical ones, and the next great labor platform.

However, the development of an immersive metaverse at this scale is likely decades away. The metaverse will not be owned and controlled by one company. It will emerge through the collaboration of many. One of the key attributes is that you’re able to jump in between different worlds, much like how you can access different websites, services, apps on the internet. It’s impossible to predict how exactly the pieces will come together and even what new forms of activity it will create, but at this stage Roblox is looking like a decent bet towards bringing the metaverse to reality.

Business model

Roblox monetises its platform through selling Robux, the in-game virtual currency, to players. This model is typically known as a Free-to-Play (F2P) model which has driven the growth of the games industry in the past decade, now generating upwards of 80% due to mobile games. Historically games were premium, paid up-front as you would with regular purchases. Games have now evolved to monetise the player base through in-game purchases, which has been a great innovation in the industry. The potential audience is essentially anyone with the means to access it, but the potential monetisation is as much as anyone wants to spend. The demand curve is not cut off at a specific point as with premium, so you don’t lose players who don’t want to spend much and you capture those who do.

There are two main reasons users will buy Robux: to spend on experiences (access, items, upgrades, game specific content) and to spend on their avatar (cosmetics such as skins, accessories, clothing, etc).

Roblox can sell Robux through the client, including directly through their mobile apps, with the price difference reflected at 10% (except at the €20.99 mark, for some reason). This is nowhere near the 30% that the app stores charge, but this is a wholly separate and interesting story - how do they circumvent the App Store rules, especially considering the whole battle between Epic Games and Apple? If you’re interested, this article by The Pause Button (excellent newsletter generally) covers this here - the tl;dr for payments is potentially exempt under the Reader’s clause.

The average price of Robux is mentioned in the filing as $0.010, which is about right (my figures are in euros due to my location).

Players can buy Robux directly, but they can also buy Roblox Premium, a subscription that Roblox rolled out in September 2019 to replace their previous iteration of this called Builders Club. Currently, there’s only a monthly option, and the key benefit is getting more Robux for less. The maximum current subscription is limited to €20.99, and the discount scales maxing out at 29%. It is also important to note that you can only subscribe to the lowest subscription tier of €4.99 through the app.

Clearly, this move incentivises any player who regularly buys Robux and engages with the platform to subscribe, providing better stability to Roblox revenues. There are also various other perks that come with Premium, such as exclusive items and discounts, in-game features (like boosters), and the ability to trade items. Developers that attract engagement in their experiences also get paid more based on time spent from Premium members (detailed further down). I expect Roblox to provide more incentives over time, and there’s an opportunity to release year-long subscriptions and tie-in benefits. I can see this set up the stage for an Amazon Prime type strategy, especially if they get creative with what can be bought through Roblox. This will not only create even more stable and recurring revenues, upfront cash flow but encourage Roblox Premium members to engage and spend more, similar to how Prime members spend c.2 more than non-members.

Roblox also generates negative revenue; a line aptly named other revenue. This consists of revenue from “advertising, licenses, and royalties”. Although this currently seems to be a money sink for them, it represents a potentially large opportunity going forward where they collaborate with brands to host special events, inject other IP and present ways to market to their large audience. They list partnerships from big names like Warner Bros, Netflix, NFL, Marvel and FC Barcelona. This ties in with the metaverse concept detailed above. The more collaborations they do, the more they’re able to create a virtual space that encompasses different worlds outside of what’s possible in Roblox.

The Roblox Platform

Roblox Client

The Roblox client is truly cross platform, meaning it can be accessed on mobile, PC/Mac, Xbox and even VR. This is the portal that users login to access the experiences that Roblox has to offer.

Technically on PC, you browse the experiences on roblox.com and when you jump into a game, it launches the Client. Interestingly, Roblox can monetise the homepage by offering ad space, with 3 types of ads that developers can bid for (using Robux) like in a traditional ad auction.

The Roblox Client displays a variety of different options outside what game to play. Users can navigate community groups (not just in-game guilds, but interest groups and official game studio pages), have their own public profile and find other people. Everything you need to find friends and communities, personalize your profile and even follow and add people is all in the platform. There’s even a public feed and Roblox is basically short of a stories feature to being fully fledged social media (not suggesting they go ahead and implement that). Having everything in one place that integrates seamlessly with games is a purposeful product choice that has contributed to Roblox’s success. If you’re a young teen looking for games that you can easily, frictionlessly play with friends, the Roblox client delivers everything for you.

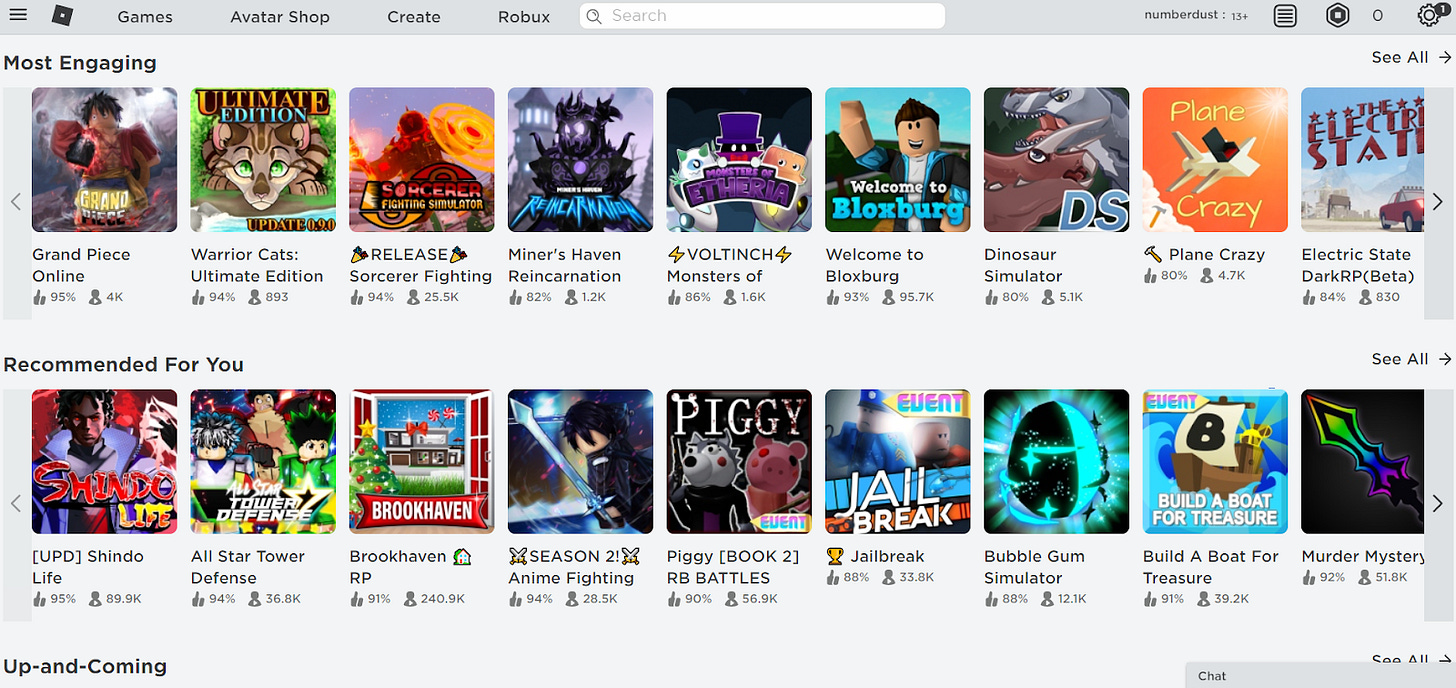

Worlds in worlds

The appeal of Roblox starts in the breadth of experiences as well as the depth of many top rated ones. All the experiences are free to play, so anyone can sign up and jump into one. When opening up the game, a user is greeted with a landing page that displays rows of icons of all the different experiences available, sorted by engaging, up and coming, popular, top-rated, and various other filters. The amount of content available is seemingly endless and when going through what’s on offer, you can see why so many people (mainly youth) are drawn in. The nature of the content provides immersive experiences and you can immediately jump into any game and find out what’s fun. You have to put yourself in the shoes of a young teen that is presented with the ability to find friends, roleplay fantasy characters, build their own house, live in their own virtual city, play any kind of minigame and just hangout with people - all in one place. That’s exciting.

The Client has a smart recommendation engine that tries to deliver personalised recommendations and learns your behaviours the more you use it, emphasising experiences where friends are present.

With cloud gaming becoming a reality, many people speculated who would be able to create the Netflix of gaming, although this analogy is more weighted towards the subscription for content business model. Roblox is the closest thing out there (note the similarity of the Netflix homepage and above), however the much more apt comparison is the YouTube of gaming. Aside from the differences in how people consume games versus TV/film, the success of YouTube comes from the abundance of content from individual creators catering to every single niche you can think of. Roblox is able to deliver this for gaming. In the same way YouTube has empowered any individual to create their own video content, Roblox is doing the exact same thing with gaming content. The recommendation algorithm drives content, but because this is not a solo viewing experience, social and friends aspects drive engagement. Roblox understands this and balances both.

Putting the games into perspective, as of writing this (22.02.2021), these are the concurrent players for the top 5 games (sourced here):

Adopt Me! - hatch pets, do quests, trade: 466k

Brookhaven RP - build your own house, drive cars, explore the city: 412k

Welcome to Bloxburg - get in-game jobs, socialize, go to parties: 120k

Murder Mystery 2 - social deception to find the murderer: 103k

MeepCity - roleplay and collect items: 101k

These would all be in the Top 10 most played PC games on Steam right now - even more than GTA V which is at 100k (see here). Steam is the biggest platform for PC games, and essentially is most of the market which Epic is now challenging with its Epic Games Store.

The games individually are not anything special or spectacular, however they are all designed around social multiplayer and incorporate some element of roleplay, simulation or tasks based around collectables or in-game social hierarchy. Roblox also gives its developers specific blueprints about how to increase engagement (see here), which include some classic concepts in progression and achievement. It’s not uncommon to see public leaderboards displayed in-game.

Diving deeper into data on the experiences, the filing gives us some interesting charts (although difficult to read) on how much is on offer, and how these experiences are concentrated and are engaged with overtime. I added lines to the left chart to compare.

The left chart shows engagement by 90% of the users in the top 1,000 experiences over the last 12 months. The overall trend shows that the top 1 made up roughly 10% of all engagement hours and the top 10 just shy of 40% engagement hours. Both of these brackets got more popular over time, taking a lot of share from top 10-50 showing that the best games are doing better at keeping players engaged. This may also be a nice effect from Roblox Premium (their subscription service rewarding engagement time), which I’ll go into more detail about later.

The right chart is a little confusing to read, but it shows the top 100 grossing experiences since January 2015, so a much longer view back. Each colour denotes the year an experience was created, and it seems the y axis is ranking, with 1st being at the top. The main takeaway is that there are many new experiences that create hits, and the filing tells us that almost half of the highest-grossing experiences are made in the prior two years and a third in the same year. Roblox is able to keep its content fresh with its developer model.

Socialising

The other key element to what makes Roblox fun is the social interactions that emerge. The experiences allow you to easily meet, play and explore with random other people playing, which can spark a friendship group’s forming. More often, players are playing with friends they know and the experiences are centred around this social gameplay. The power of being part of a community in a fun virtual world cannot be understated. Roblox offers an environment that delivers unique moments for free, creating memories and experiences that keep players coming back. The game elements will incorporate clever ways to encourage progression and engagement, wrapped in social validation. If all your friends are spending time in a certain game, you will want to as well. If your friends find another experience in Roblox that’s fun, they’ll invite you. The chance of churning out is lessened when you can follow and be invited by friends to new experiences. The chance of returning if you do churn out is higher for the same reasons. Ultimately, Roblox can retain their players for much longer.

I want to contrast and labour this aspect of Roblox. Socialising in gaming has been around ever since multiplayer gaming started gaining traction in the mid-2000s, but was never a focus area but rather an afterthought. Even today, Steam (as mentioned earlier) has limited social features. They only relatively recently introduced voice chat and their messaging platform is honestly quite poor - one of the reasons Discord, the (originally gaming) communications platform, has done so well. Even games on the platform that link to the Steam friends system is basic.

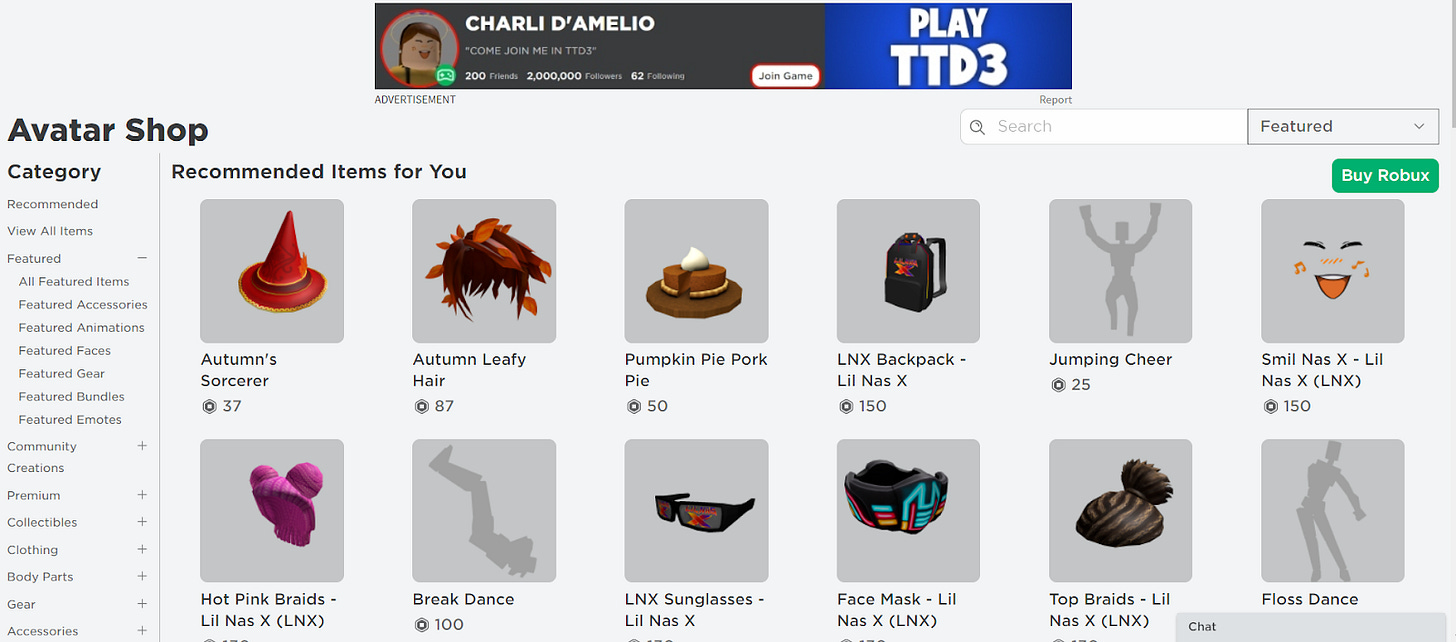

Identity

Roblox’s blocky avatar style is at this point iconic in the game world. Distinctly aimed at a younger generation, but playfully unique. Roblox has actually come a very long way since it’s initial avatars and now you can get quite high fidelity graphics. At first, the use of avatars may seem fairly inconsequential. Many games have some form of avatars, so why does it matter here? Players can customise and personalise their avatar through buying clothes, emotes, gestures, accessories all made by the community, or ‘Creators’ as Roblox calls them. This again is leveraging the creativity of the community to shape how players identify themselves. Many other games only provide cosmetics created by the developer, with input or competitions from players. Roblox originally started with this model, but since 2018 they have enabled users to create their own on the marketplace, which has been successful. On top of this, the avatar is persistent with any experience you load in Roblox. The fact this carries across in different games gives a sense of agency that develops more attachment to their avatar and persona created in Roblox.

Below are some of the avatars and how the look has evolved from left to right:

Below is what you see in the Avatar Shop. At first glance it may look random, but even on my default page it’s clear they understand their users. At the top is an advertisement to join Charlie D’amelio’s game - one of the biggest Tik Tok creators. Within the avatar shop, you see items linked to Lil Nas X, a Gen Z music sensation also driven by Tik Tok (and recently performed a live concert event in Roblox).

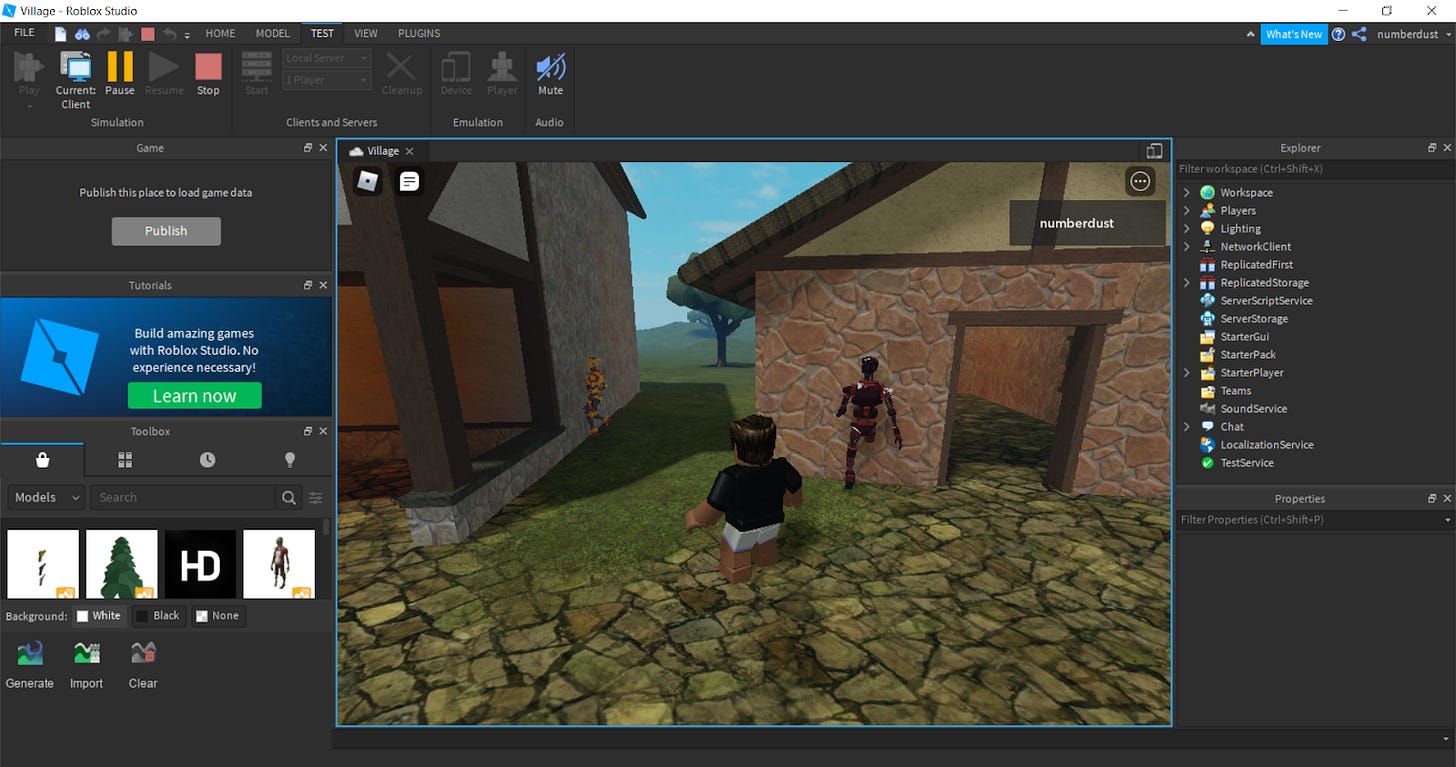

Roblox Studio

The engine and tools behind making all the experiences is delivered alongside the Roblox Studio. This is a separate piece of software that is easily downloadable and is free. It’s from here that anyone can build, publish and operate games on the Platform. The Studio includes many templates you can base off and many premade assets (textures, meshes, 3D models, animations, characters) to get going. Although it’s relatively easy to get started, you can make sophisticated games through Roblox’s own coding language Roblox Lua, which is based off a popular programming language in gaming, Lua. You can also install various plugins that allow for more functionality, made by the community or you can create your own.

Although anyone can create a game, publish it on Roblox and start collecting in-game Robux, actually being able to cash that out requires meeting certain criteria: you have to be a Roblox Premium member, you need at least 100,000 earned (i.e. from your game or Avatar items), over the age of 13 and essentially have no marks on your account that could go against your community standing.

There is also a separate Roblox Studio Marketplace where developers can share and monetise their work for other developers. It has 30m models, meshes, textures, scripts, audio clips, tools and other packages. This again leverages the community’s creative power to feedback into every developer making each wave of new experiences better than the last.

What makes the Roblox Studio powerful is not just the software itself but the community that has developed around it. There are thousands of tutorials and videos online, both driven by Roblox and the community around it. There’s an official Roblox Developer Forum where the company gives updates, online lessons and Developers themselves discuss topics, get feedback and find opportunities to collaborate. On top of this, there’s an annual Roblox Developer Conference (RDC) where the management team give a lot of info and updates on the company, almost like an annual meeting but geared towards developers. They have their own annual award show called the Bloxy’s which celebrate the best games and developers.

Roblox Cloud

Roblox Cloud is the infrastructure that powers the rest of the platform, delivering all 3D simulations and is the reason Roblox is easy to play on any device. On the surface, this may seem inconsequential, but the capabilities of their cloud platform is another key differentiator that is difficult to replicate and enables Roblox to deliver the immersive and many experiences it does. On top of enabling low latency experiences, the Cloud stores the social graph and makes sure players are automatically placed in the same environment as their friends based on a variety of factors, such as age and skill level. They have introduced automatic translation of experiences from developers into 11 different languages, enabling developers and increasing the value for players. They have specified as a potential risk that Roblox Cloud will be relied more and more for enhancing experiences, such as ‘synthetic content generation’ and ‘automation of player experiences’. As Roblox develops, more aspects will be automated and may result in unexpected outcomes.

To put this into perspective, current games which host many people in games rely on ‘sharding’ of servers. The technology is not quite there yet to allow for a huge number of concurrent users on a specific server, so sharding assigns a number of users to a particular server. In Roblox’s case, that is up to 100 people. This means that even though many people can join a game, you won’t be able to interact with everyone in real-time. There are companies that are trying to tackle this problem (most notably, Improbable, which is a Softbank portfolio company and Hadean that has worked with Eve Online and Minecraft - both London based). I would not be surprised if Roblox is also figuring this out as it would enable experiences that can have massive amounts of users. They are already experimenting with some experiences to host 700 maximum players (see here) however there remains a lot of scepticism about lag and playability at these numbers.

Roblox has 21k servers as well as a partnership with AWS when additional compute is required (which is currently to be renewed in November 2021) - typically for small updates that require speed. They’re continuing to build more data centres and in their investor day, called out India as an investment area. I was not able to find any significant instances of outages nor any stats on uptime, but this seems to be in good standing.

Crowdsourcing content and rewarding developers

During 2020, over 7 million developers were active in creating experiences for Roblox. The top developers are earning significant amounts of money and with the growth Roblox has experienced this year, Roblox paid out in Q4 2020 3x the amount they paid out in Q4 2019 through the Developer Exchange program:

The charts below (over 2020) show that 1m of these developers earn some sort of income, and 36 experiences earn over $1m. The right funnel also gives an idea of how much engagement individual experiences can get, with 272 games getting over 10m engagement hours.

There are 4 ways for someone on Roblox to earn money:

Sale of access to, or enhancements of experiences they create (70% cut for devs)

Sale of items to users through the Avatar Marketplace (30% cut for devs)

Sale of content and tools between developers on the Studio Marketplace (70% cut for devs)

‘Premium Payouts’ - engagement-based rewards that reward developers based on number of hours spent in their experiences by Roblox Premium members

Roblox rolled out their Premium Payouts in March of this year. This is a great move that now incentivises and rewards developers when their experiences are getting loyal followings. Previously, it may have not mattered as much if your game was loved by many people versus a relatively flash in the pan game that garnered more individual users. It also allows developers that don’t have time or the desire to build in good monetization systems to just focus on making a game that people engage with.

Note that Roblox will payout users when they cash out - they can (and do) choose to keep their Robux in game to use wherever else, whether that’s in other games or even their internal ad network to promote their games.

Roblox currently rewards 70% of Robux spent in their experience to developers, and 30% of Robux spent on items in the Avatar Marketplace and content and tools marketplace. When developers want to cash out, they get a fixed exchange rate set solely at Roblox’s discretion. Right now it’s at $0.0035 for 1 Robux. This was increased from $0.0025 3 years ago in March 2017.

This essentially means that c. 24.5% of spend in experiences falls to developers (i.e $10 becomes 1,000 Robux => devs keep 700 spent in experiences, cashing out at $2.45 (700*$0.0035). Based on the 70/30 experiences/marketplace split noted above, about 17% goes to developers (70% * 24.5%) + (30% * 10.5% (30% marketplace commission * $0.0035)). This is reflected in their financials which I go over near the end.

This an interesting lever they have, and may be cause for concern. However, Roblox explicitly states multiple times that their goal is to drive as much money to developers as they can. Aside from investing in infrastructure, tools, and everything for the Roblox platform, they intend to use cost efficiencies gained from other areas back into increasing developer fees.

The primary source of revenue comes from Robux spent from players on game experiences - during their investor day, management stated that c. 70% is through experiences and 30% is through the marketplace. This also raises some further questions: can they sustain this cut? As Roblox grows and more businesses rely on Roblox for their games, they will ask themselves whether a 25% in-game cut is really fair when in fact you’re able to go directly to market, or go through Steam or Epic Games Store and get a much higher 70% cut or higher.

As mentioned, Roblox will continue to reinvest efficiency into giving more and more to developers, so the 25% cut may go up or they will introduce further ways to reward developers. But Roblox is still a business and needs to maintain their own profitability. Below is a slide from the Roblox Investor presentation which summarises what developers get when they give up 70% of sales that happen in their experiences. I’m convinced that all these benefits will help Roblox sustain strong economics between themselves and developers. The benefit of Roblox is making is much easier for anyone to create experiences and content which is the lifeblood of the platform.

The Roblox growth engine

The driving force between what drives the value of the Roblox platform can be summarised with the above chart:

Content

Developers and Creators create content that powers the platform

They build increasingly higher quality experiences which attract more players

More players results in higher engagement and spend, in turn incentivising Developers and Creators to create more and better experiences

Social

Players play with their friends, invite more of their friends and drive organic growth

The value of the Roblox platform increases to an individual the more their friends play together

More friends and better experiences drive even more players to join

As with many other successful internet business models, Roblox can take advantage of network effects in both social and content that both reinforce each other, gives more reasons for players to play more as their friends play, and pay more as the experiences become more valuable to them.

These two network effects have demonstrated great success so far. Not only does it allow for a scalable business model for Roblox but also gives me comfort that as long as Roblox can continue to provide a strong platform for players to access and developers to create, the business will grow healthily.

A very young user base, but geographically spread and gender balanced

54% of Roblox users are under the age of 12 and only c. 15% of their total users are over 24. Roblox is likely one of the first major games kids get into. This is both an advantage and a disadvantage. On one hand, Roblox can directly shape expectations for games as users grow and creates loyalty at a young age. On the other, it may be the case that users graduate from Roblox and churn out once they hit mid teens to move onto more ‘grown up’ games. This is certainly something Roblox is actively aware of, more notably as they realise spending power is much higher amongst older users. As one of their growth strategies, they highlight age demographic expansion and believe there is significant potential here as they offer the tools to build higher quality experiences.

Overall, the geographic split of users is heavily weighted towards the Western world - 33% of users are based in North America and 29% are based in Europe. In terms of revenue, the concentration is very weighted towards US & Canada which made up 68% of revenues in 2020 which means they spend 3.3x more on an ABPDAU basis (Revenue / DAU for time period) than the next biggest demographic, Europe (19% of revenues).

Growth strategy and the future of Roblox

Roblox have outlined four key areas:

International reach

Age demographic expansion

Platform extension

Monetisation

International reach

The company is already well established in Western Markets as seen above, and is increasing its efforts to expand globally and the management team expect significant growth in Western Europe and East Asia in the near term. During their 2020 Roblox Developer Conference, they highlighted that engagement hours shot up in South Korea, Germany, France and Russia as the pandemic hit.

In the mid-term, the biggest opportunity is most notably in China, where they have gained approval to launch with Tencent. I will expand on this later on.

Roblox is well-positioned to continue to grow in other countries and have invested in the platform accordingly. The Roblox Client is available in 45 languages and is about to complete the rollout of their automatic translations for every in-game experience. These translations don’t just allow bigger reach but also better retention of players in-game (quoting a significant uplift in new player playtime and Day 1 retention during RDC 2020). There’s also additional safety and compliance measures that need to be in place, which is a framework that Roblox has invested in heavily. This will include geography specific platform updates like screen time limits, age verifications and authenticating identity.

Roblox noted in their investor day that once they determine there is enough organic traction in a certain market, they will make the decision to properly launch through influencer relationships, brand collaborations, marketing and localised customer support.

Age demographic expansion

As seen above, Roblox is very heavily weighted towards a young demographic. Early indicators show that they are making good progress in attracting a somewhat older audience, with over 13s DAUs doubling in 2020 (vs under 13s growing 74%).

Their strategy to attracting an older demographic is centred around 3 current initiatives:

Enabling developers to build higher fidelity, more sophisticated and polished experiences with better simulation and faster loading.

Better Avatar technology. Recent updates included being able to layer clothing, which sound simple but allows for more creative and better looking avatars. Additionally, with their acquisition of Loom.AI, they will introduce facial tracking so avatars will now be able to have non-verbal communication.

Better content matching and personalization. As they promote more mature content on Roblox, they need to make sure the platform is effectively getting the right demographic in front of the right content based on age, geography, social graph and skill level. They will also be putting in age ratings to content.

All three of the above should help facilitate content that older users will want to play. It’s not yet clear if this will actually translate to a big growth in older users, but what is also key is that they retain current ageing users so that they don’t graduate out of Roblox as highlighted above. In their investor day, the CEO also called out specifically that the 17-24 cohort in the US is growing very rapidly as another early indicator. During RDC 2020, they show that this cohort has grown to 25-30m MAU (Monthly Active Users) by the end of 2019, with a huge jump in the latter half. They also estimate their penetration of 9-12 years in the US is close to 80%.

Platform extension

This relates to their ultimate vision for Roblox as not a gaming company, but a platform for a variety of virtual experiences and the metaverse. Currently, most experiences are centred around play, but the management team wants to expand to other verticals, focusing on education and the future of work. Alongside this, entertainment experiences are already an avenue they are exploring closely.

The most near term and tested opportunity is around entertainment. Having done their Lil Nas X concert and worked with a number of brands and other media, they still opportunistically explore collaborations. The key here is to create collaborations that are more than just a one off event. In November, Roblox partnered with the Ready Player One IP owners to create an ongoing event that allows players to go through a treasure hunt inspired by the IP and earn special rewards. We will start to see more of these ongoing collaborations, which benefits both Roblox and the IP, and creates more long term engagement with users.

It’s still far too early to tell if these types of experiences will be successful, deliver meaningful ROI or form a significant motivation for users to play. Current viewership numbers for these events boast records in the 10s of millions, but viewership numbers do not really tell you how deeply users are engaging and what impact this is having on the acquisition of new users or retention for current ones.

The management team does state that they are closely measuring the impact of these sorts of events, so as long as they continue to experiment I am hopeful they will find formats that work. Everything that is being built in the product to create better, more immersive experiences such as spatial audio and avatar animations will benefit their more ambitious goals of incorporating educational experience and facilitating work environments. At this stage, it is a potentially large opportunity but one that is too speculative to put any concrete value towards. Refocusing the conversation around play and making games, I do expect that as Roblox improves the quality of games that can be made, we should start to see games that grow and command a more loyal userbase.

Monetisation

Getting users to spend more is an immediate opportunity for Roblox. Their initial ‘easy wins’ here will be making it as easy as possible to buy Robux, so offering more payment methods, supporting new currencies, distributing gift cards and increasing Roblox Premium penetration. One key feature in the works for Premium is allowing users themselves to offer a monthly game pass to their experiences, which is in the works for 2021.

Their most interesting opportunity here is collaborations with brands, with branded merchandise in the game. They believe Roblox’s combination of scale, demographics and engagement delivers a unique opportunity for brands. They’re also very clear that they do not want to pursue any ad-supported models in the traditional sense, and envision a world where brands natively create experiences within Roblox to engage with their userbase more authentically and potentially unlock new ways to experience brands. We have also seen Fortnite do exactly this with Nvidia, creating the RTX Treasure Run where players play through a map to showcase ray tracing and the new graphics card.

The analogy given during the investor presentation was as Facebook allows brands to create their own Facebook pages, Roblox will allow brands to create their own Roblox worlds. If you believe that virtual 3D experiences will improve with people engaging with them more, it follows that brands and commerce will want to follow.

There is a lot of potential here, and could open new business models for Roblox - not just for selling real-world items and taking a commission, but selling virtual branded goods that start to look more like a GMV (Gross Merchandise Value) revenue line. As of writing this, there is also a lot of momentum behind Non-Fungible Tokens happening right now, which is basically blockchain-backed authentic ownership of unique digital items. I won’t attempt to go into detail here, and although I remain skeptical on it’s application this may open up some interesting opportunities with better economics for digital goods that are creator driven.

Interesting numbers and charts

Premium Subscribers

Unfortunately, Roblox hasn't publicly released data on the specific number of Premium subscribers. I suspect it’s still too small of a number. During the RDC 2020, there is a chart which annoyingly does not have a Y-axis, but demonstrates the growth since they converted their Builders club to Premium. This is expected, and it’s hard to glean much from here. One interesting stat that the CEO does give is that over 200 of the top 1,000 games are making more Robux from Premium engagement income than direct purchases within the experiences.

Average lifetime of paying users is 23 months

Roblox users that spend tend to stay engaged for a long time. It’s difficult to infer anything from this number alone such as calculating LTV (lifetime value) for paying users (as we don’t have average revenue for paying users), or doing a simple calculation that implies monthly churn is c. 4%. There are many retention curve profiles that could result in this average lifetime. Retention curves in games differ greatly depending on its genre, and as Roblox offers a variety of different experiences you cannot easily take an average for a whole genre. The filing notes that the average lifetime of paying users has stayed at 23 months for the last 3 years, and is subjective that includes management judgement. I would like to see this trending upwards, but almost 2 years still speaks to the longevity of players. During their investor presentation Q&A, the management team believes this will trend up in the future as they invest more in the platform.

490,000 daily paying users

Almost half a million users pay money into roblox every day. That is an astounding number, as typically most F2P games that have any spenders at all are in the single digit percent. Roblox cite this as the key reason that revenue has increased, and this shot up from 184,000 in 2019 almost tripling (2.7x). Again, this is driven by lockdown measures and I do not expect this to sustain going forward as we come out of it. For comparison, 1.04% of DAU were daily payers in 2018 and 2019, this grew to c. 1.5% of DAUs in 2020.

79% of Roblox FTEs are in product or engineering

Every 4 out of 5 people that work are Roblox are dedicated towards improving the product. There isn’t much else to say that this is a great sign and gives me assurance that Roblox will continue to innovate.

It’s also worth highlighting here that Roblox recently hired Daniel Sturman as their CTO in January of 2020, who used to be at Cloudera, Google and IBM. Notably he was CTO at Cloudera when they IPO’d, which is likely one of the reasons he was brought onboard.

Rising spend per user completely offsets cohort churn

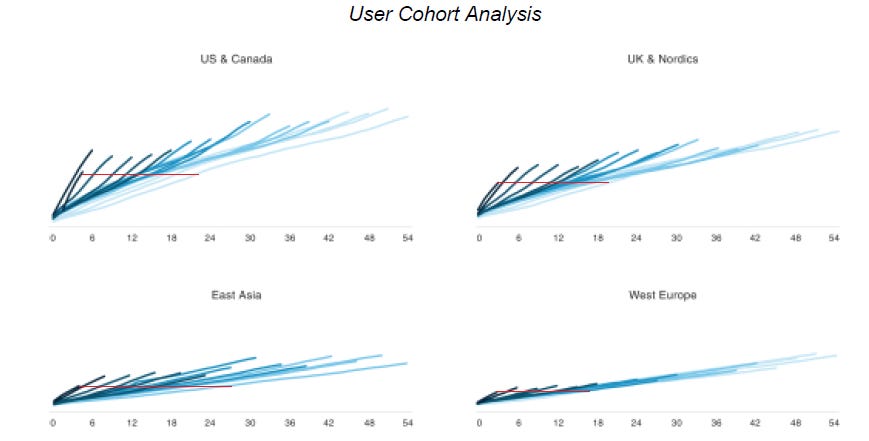

It would have been great to get more detail around cohorts, especially a breakdown of current revenues by cohorts to understand how they are evolving. Unfortunately little is provided, but at least there is something. The charts below show cumulative bookings of all signups per quarterly cohort since 2016 (so 19 cohorts). It’s difficult to count every line as there’s overlap. The darker the line the most recent the cohort. It’s interesting that the lines do not level off over time. The key takeaways are:

The latest cohorts spent in 6 months as much as the oldest cohorts did in c. 18-24 months, although this has also been driven by COVID

Retained users from each cohort are monetised more overtime, to the point that they replace spend lost from churned users almost completely

Assuming the Y-axis is the same for all charts:

The UK and Nordics are separated from West Europe as they spend to the level closer to US users

Western Europe (primarily Germany, Spain, France, Italy, Belgium and Portugal) and East Asia (primarily South Korea and Japan) have similar levels of spend from older cohorts, but newest cohorts from Western Europe are spending much less

Huge spike in hours engaged with Roblox

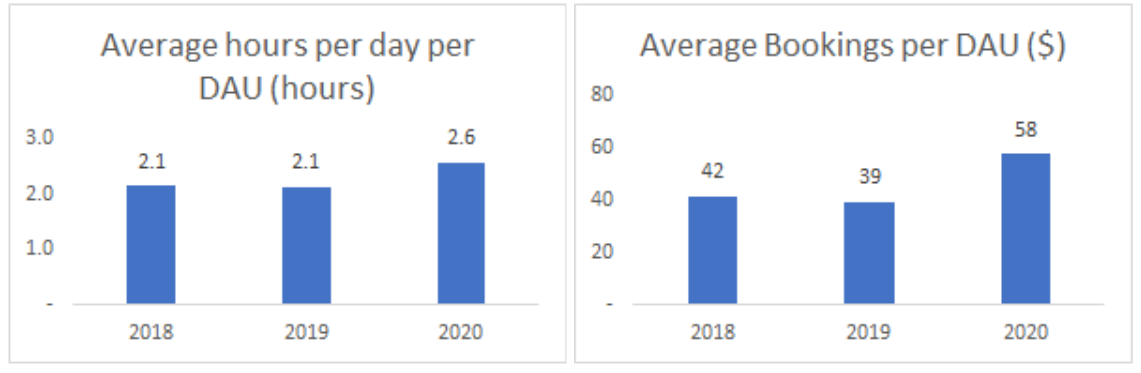

Hours engaged with Roblox after lockdown measures came into place immediately doubled in Q2 2020 vs Q1 2020. This translated to an average of 2.6 hours spent per day per daily active user. This growth is pretty insane, even with the lockdown measures. With all the free time available, players started spending over twice the amount they previously did. You can see this new high has been holding well throughout 2020, with the slight dip in Q4 in-line with prior year seasonality. This further supports the amount of content that is available and Roblox states they believe that this reflects the increasing value of the platform. Many other games companies suffer from not being able to deliver continuous content or require significant investment to quickly scale engagement, but Roblox’s inherent model means this is much less of an issue.

The China opportunity

Roblox is teaming up with Tencent to release their app in China. As the biggest and most lucrative gaming market in the world ($44bn in 2020), this is a big deal. Not only are there a lot of gamers in China, but they tend to spend a lot on gaming. Gaming in China is much more socially accepted. The filing details that Tencent had applied for a license and since then they have been approved by the Chinese government, so it seems full steam ahead.

Roblox set up their joint venture (Songhua) with Tencent’s subsidiary Luobu in February 2019. Since then, they’ve likely worked on hashing out how the game would look for China. It’s certainly not straight forward, as Roblox is a game where users create the content and China is a market where the government has strict controls over what games and content are permissible. They also spent this time on ‘creating opportunities for local Chinese developers to learn Roblox Studio for building and publishing experiences and content’ which is a nice way of saying that it should conform within strict guidelines. Since they’re also making an entirely separate app in China (Luobelisi), I’m confidently assuming this will be separated from the rest of the world and have various restrictions. With the support of the biggest gaming publisher in China, they should stand to be at a good footing but this is still a big risk for them as the government could still choose to impose restrictions in the future. Tencent remains under close inspection, and this is with the backdrop of increasing tensions between the US and China which is noted in the filing.

It’s also important to appreciate that the Chinese gamer preferences are quite different to Western - both in terms of genres, types of content and themes. China is much more heavily weighted towards ‘core’ game experiences, which is typically MOBAs (like Honor of Kings, League of Legends, Dota) or MMORPGs (Fantasy Westward Journey). A comparable example is Minecraft entering China which has a huge 400m registered users (although, unclear how many of these are active):

There is also a Roblox clone dubbed Reworld that has raised $58m in venture funding, but it’s currently unclear how much traction they have received. Roblox will need to tread carefully, but as the content will be for the youth, they should have a comparatively easier time.

Trust and safety poses one of the biggest risks

With so many young users on the platform interacting with each other and playing a huge variety of content, safety is of huge importance to the long-term sustainability of the platform. Roblox has 2,300 trust and safety agents (they are not full time employees). On average they state a human is able to respond to inquiries within 10 minutes.

Roblox uses ‘machine scanning’ and dedicated teams of humans to moderate content (images, sounds, video). They also monitor all communications that happen on the platform with this algorithm to detect bad behaviour - examples given are questions on personal information and details on how to chat on other less secure applications. They also provide parental controls.

There is also a Safety Advisory Board made up of industry experts (you can see them here). During their investor presentation, the management team tells us that one of the ways they structure their product roadmap throughout the organization is based on yearly arcs with differing priorities. This year, their key priority is safety and civility. Roblox obviously recognizes how important this is to the platform, both short-term for brand and reputation and long term for user growth and engagement. Other initiatives include their Digital Civility Initiative, where they have created official courses that teach kids about how to spot abuse and bad behavior in-game. They’ve even created in-game scavenger hunts to teach these concepts.

This is one of the biggest risks for Roblox in the long-term. If there are too many instances of abuse, fraud, unethical behaviour, etc then the Roblox brand will suffer. Unfortunately with the scale that Roblox has achieved, there will likely be instances of this happening. Current examples include child grooming, virtual character assaults, and various scams.

Increasing reliance on mobile

The shift towards mobile has been an excellent decision by management. This may seem obvious now, but even today many big gaming publishers were very slow to make any meaningful progress in mobile. Mobile still remains the fastest growing market in gaming and biggest studios need to acquire these capabilities or get left behind.

In 2020, 35% and 19% of revenues were from the App Store and Google Play, respectively. The App Store revenues increased from 30% in 2019 with Google Play remaining flat at 18%. On top of this, 68% of engagement hours during this time were from players that signed up on mobile. This means that Roblox is beholden to the terms of the app stores and will increasingly pay the higher 30% processing fees on bookings made going forward.

During the investor day Q&A, the management team specifically mentioned they have strong relationships with the stores. Roblox ships updates to the stores every week which goes through approval processes from the relevant teams at Apple and Google. I don’t foresee any Epic like battles going on, but that is assuming nothing significant changes in their partnership.

Management team and Board

I’m not going to rehash the bios that are already in the filing but highlight a few points that I feel are important.

Firstly, David Baszucki is the CEO and as the co-founder with Gregory, has grown the company from concept to where it is today. I have no doubt that his vision and experience is crucial to Roblox’s success going forward. Craig Donato joined as the Chief Business Officer in December 2016 and brings across expertise from online platforms and marketplaces playing a key role in scaling Roblox.

The rest of the management team are all actually fairly new, having joined in the last couple of years, and were likely brought on board to prepare Roblox for the listing. As mentioned above, Daniel Sturman (CTO) joined super recently in January 2020 and brought across cloud expertise which is critical to Roblox’s operations going forward.

The Board is small with just 5 members and only includes David from the executive team who is also the Chairman. Alongside his co-founder and brother Greg, the Board has Anthony Lee from their early investors Altos Ventures and he also acts as the Lead Independent Director. The second independent director is Christopher Carvalho who has significant experience in gaming and entertainment, with senior positions at Kabam, Lucasfilm, G5 Entertainment and Modern Times Group. Lastly, Andrea Wong recently joined the Board in August 2020 who was the President at Sony Pictures and has had various positions at large media companies. The combination of the Board brings across significant gaming and media expertise.

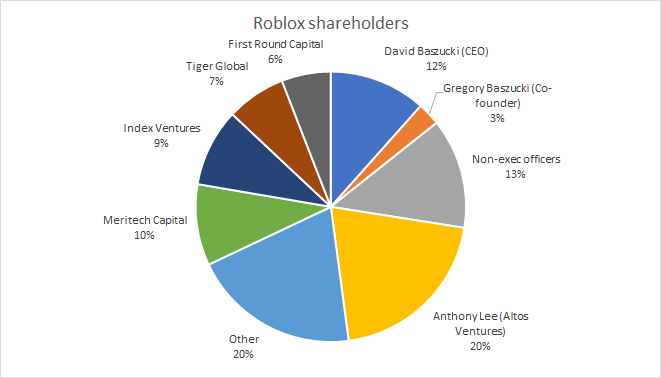

Shareholders

The above chart shows economic shareholders based on the registered stockholder shares table, primarily under the line which shows all holders over 5% (totalling 512m Class A and 57m Class B which is all held by David Baszucki). Only David’s brother and co-founder Gregory holds a significant share, with other members of the management team less than 1%. Also, a large chunk of 13% is held by the group comprising non-exec officers and non-direct service providers.

What’s important to note here is due to the classic tech share structure, David’s Class B shares hold 20 votes per share (versus 1 vote for Class A) and therefore gives him 70% of the voting rights and complete control of the company’s direction. This may pose risks down the road if David’s decisions are at odds with shareholders, but given the success of prior founder-controlled tech companies producing the most successful companies in the world, I am comfortable with this setup.

Anthony Lee which represents Altos Ventures holds 20% with the joint highest position, a VC fund that’s been in Roblox since its Series C raise back in 2008 so a long-time backer and consistently followed every round to build an incredible position. No doubt they are extremely happy with their returns.

Notably, the group of all other registered stockholders holds 20% of the company, which I assume are employees and early investors comprising of individuals and groups of angels / other investors.

Financials

Bookings and revenue

Understanding the importance of bookings versus revenue is important. It is standard practice for games companies to report bookings or adjusted revenue alongside GAAP revenue for the same reason. Bookings as far as I am concerned is the key metric here, such that bookings are all the payments made to Roblox from users buying Robux. This is non-refundable and falls straight into Roblox’s bank account.

Revenue is different, and wildly different here because of the exceptional growth during 2020. The change in deferred revenue is the bridge between revenue and bookings and captures the spend on the platform for durable goods (i.e. cosmetics), and due to the fact that Roblox still has performance obligations on these sales. Therefore, the purchase of these virtual items is recognized over the average lifetime of a paying user, which is 23 months. This essentially will smooth out revenue growth over time, and you can see how much of the deferred revenue will be recognized next year in the short-term deferred revenue balance sheet line.

Roblox had to change their accounting methodology in their updated S-1 filing and had to hire consultants and new resources to correct this. Previously it was all time-based, now they recognize items that are immediately consumable as revenue versus durable goods over the lifetime. This is not a great sign, but I am okay to put this down to growing pains of going public.

Aside from that, bookings much more accurately reflect the activity on Roblox during the given period, and they have grown an incredible 171% benefiting hugely from the lockdown measures.

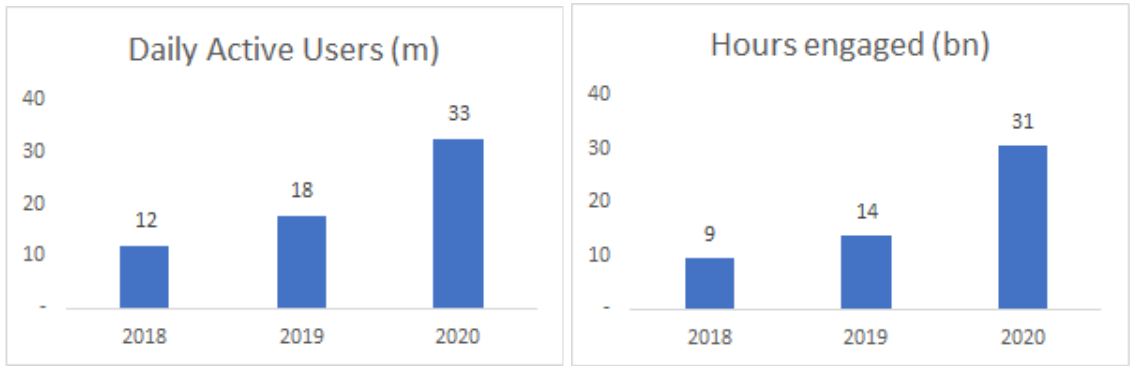

The main driver of growth is a much higher user base, growing to 33m DAU in 2020. But these users are also spending more time and money in Roblox, as seen in the two charts below. Again, as this is driven by the pandemic, management are under no illusion that these KPIs will be maintained and I expect these to fall closer to but remain above pre-pandemic levels.

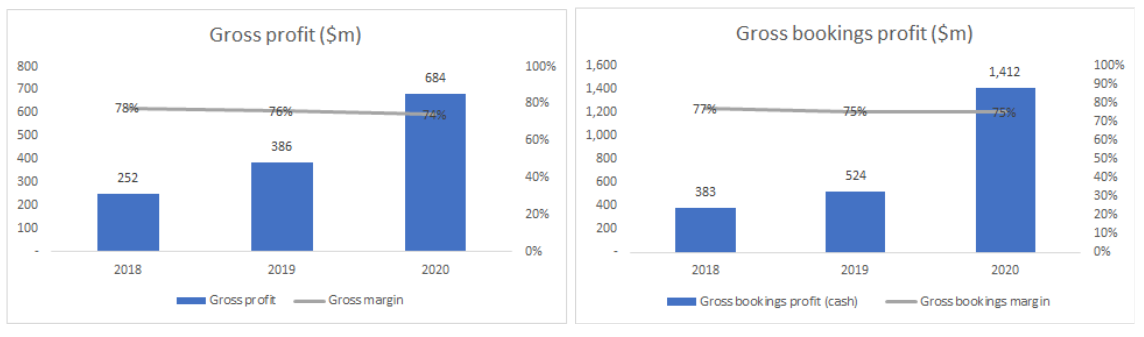

Platform fees

Gross profit is typically revenue after cost of revenue. In this case, after platform fees. I have looked at both revenue after cost of revenues, and bookings after cash paid for platform fees which are in-line. Roblox is paying c. 25% in platform fees trending steadily upwards as the mix of mobile app store bookings increases. 54% of revenue in 2020 came from mobile, implying Roblox pays about 20% in platform fees for non-mobile revenue which is surprisingly high. This trend is expected to continue as stated in the filing and by management.

Operating costs

Looking at operating costs makes more sense to take bookings as a margin, as you will see developer exchange fees margin increase as a percentage for accounting revenue not really reflecting reality. Overall, operating costs as a percentage were flat prior to 2020 where they decreased by 13%.

Developer exchange fees are increasing rapidly, and as mentioned before, any operating cost efficiencies gained is typically reinvested back into these payouts so this will rise as a percentage. You can see this in effect in 2019, as total operating costs remained flat, as leverage from other lines were reinvested into a 2% rise in developer exchange fees. These efficiencies will mainly be coming from personnel costs across all other cost lines, as well as economies of scale from infrastructure and safety costs.

Infrastructure & safety is their next biggest cost line, primarily related to servicing their data centres and personnel that support the tech and safety, which I expect to be the 2.3k safety agents they use.

R&D is all the personnel costs related to engineering, design, product management, data science, and other areas that work directly on enhancing the platform. As 79% of their employees are product and engineering, it makes sense this is the next biggest cost item for them, bigger than admin and sales costs combined.

I want to highlight here how small sales and marketing is at just 3% of bookings in 2020, demonstrating their low costs to acquire users and that growth is mostly organic. This line item also includes PR, branding, developer relations and their RDC event costs.

Cash flow

The initial chart breaks shows the difference between operating cash flow and free cash flow. Operating cash flow margin on bookings stood at 28% in 2020, with 2019 at 14% and 2018 at 20%. The dip in 2019 was mainly due to an increase in accounts receivables, which are the distribution channels they use to collect payments from customers. The company is spending a relatively flat amount each year in capex which is primarily servers and infrastructure.

As you can see, the hyper growth Roblox experienced in 2020 has meant a lot of cash falls straight to free cash flow, with a margin of 22% in 2020. Management has expressed that their long term target for FCF margin is 25%+, so they’re already close to hitting this. However, as they grow into new markets they will need to spend more in capex and the return on these investments will still take time to realise.

Balance sheet

Roblox has circa $900m of cash (which will be $1.4bn after listing) on their balance sheet, giving them ample room to survive future downturns. I’m not too worried about this considering they’re already operating cash flow positive and their biggest cost from developer fees is completely variable and tied to their bookings.

Most of the assets and liabilities are unsurprisingly deferred revenue and deferred cost of revenue from annual bookings, which unwind as stated at the beginning of the financials section. There is no significant debt on the balance sheet and they have a small $50m revolving credit facility.

The only other thing of note is the outstanding convertible preferred stock from all the venture financing done to date standing at $344m. As of November 2020, all of these were converted into Class A shares (which can be seen in a note, as well as the pro forma capitalisation) that raised the cash balance.